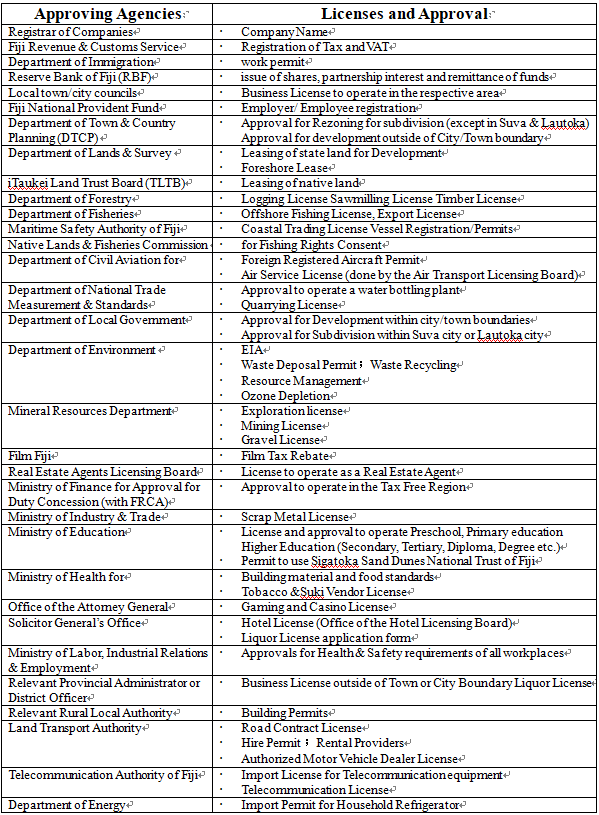

Business Licenses Approval

Any foreign investor wishing to invest and reside in Fiji will need to apply for a work permit. A key post work permit (Investor permit) is granted to a foreigner/shareholder who has obtained a Foreign Investment Registration Certificate from Investment Fiji. Initially the work permit will be issued for 1 year upon which there is an appraisal of the project in the form of a Progress Report by Investment Fiji. The Immigration Department uses the Progress Report to determine whether the permit is extended for a further 2 years, after which it may again be renewed for another 3 year period.

The application for a time post work permit (Workers) will need to be made by a company directly to the Immigration Department. Persons designated to represent the interests of foreign investors may also be granted work permits.

Coextensive resident permit may also be granted to spouse and children of the investor upon making appropriate application.

Native land is the land owned by indigenous people of Fiji and represents 90% of total land mass which can only be leased for a maximum term of 99 years from iTaukei Land Trust Board. A foreign investor cannot purchase or lease the land directly from the tradition owners, it is the iTaukei Land Trust Board that acquire the land after getting 60% signatories for consent to lease from its traditional owners prior to leasing it to foreign investors. There are different type of leases that can be obtained such as commercial, agricultural, industrial, tourism and residential. The advantage of native land is that it can be leased at a low cost with a proper legal lease but as an investor you won’t be able to own the land.

State land represents 4% of the land in Fiji and can be leased from the Lands Department or the state.

Freehold land represents 6% of the total land in Fiji which can be directly purchased between the buyer and the seller but the cost of freehold land can be expensive because of its scarce availability.

Any State land or freehold within the boundary of any town or city declared or extended under the Local Government Act (Cap. 125) cannot be sold, transferred or leased to a non-resident. But the state or freehold land can be only transferred or leased for business purpose or acquisition of strata unit title.

If construction is not completed within 24 months —

(a) a non-resident to whom the vacant State land or freehold land is sold, or leased, shall be liable to pay to the State a fixed penalty of 10% of the price at which the vacant State land or freehold land was sold or leased; or

(b) a non-resident to whom the vacant State land or freehold land is transferred shall be liable to pay to the State a fixed penalty of 10 % of the value of the land, at six-monthly intervals until construction is complete.

“Construction” means the construction of a new residential dwelling which incurs building costs not less than $250,000

For any foreshore lease the Department of Lands approval must be obtained. As the foreshore lease will encroach into the traditional fishing grounds (qoliqoli) or the fishing owners’ majority approval (60%)must also be obtained. The list of the Fishing or Qoliqoli owners can be obtained directly from the Native Lands & Fisheries Commission a division of the iTaukei Affairs Department. Please follow the traditional protocol of obtaining consent by applying through the respective Provincial Office. The head of the Provincial Office (Roko Tui) will be able to guide you on the process to be undertaken in conjunction with Lands Department.

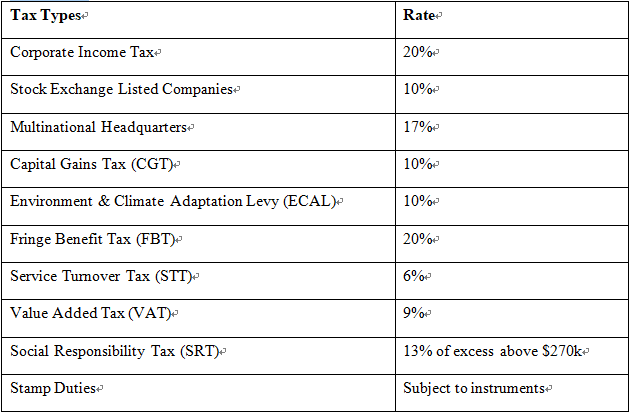

Fiji has adopted a business friendly tax structure to support innovation and investment with 20% corporate tax and a lower rate of 10% for companies listed on the South Pacific Stock Exchange:

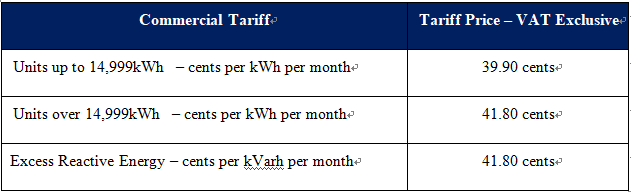

Small Business Tariff

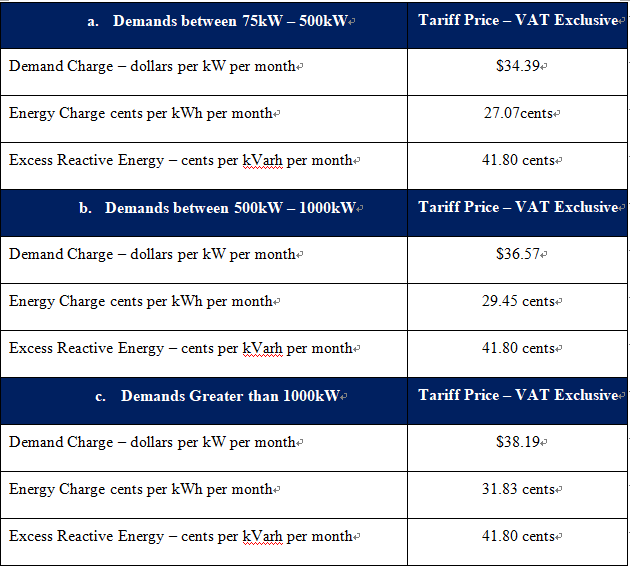

this tariff is for any business with a Maximum Demand that is more than 75kW per year:

Investors will also need to liaise with the Reserve Bank of Fiji’s (RBF) Exchange Control Unit to apply for the issuance of shares to non-residents. RBF will also verify the transfer of funds from offshore to the company’s Fiji-dollar resident bank account and confirm the amount of investment by the company.